All Categories

Featured

Table of Contents

You might have created a will certainly or estate strategy without thinking about final expenditure costs. Only currently is it coming to be obvious that last expenditures can call for a whole lot financially from loved ones. A life insurance policy plan might make sense and the money advantage your recipient receives can assist cover some monetary expenses left such as everyday prices or perhaps inheritance tax.

The applications are generally straightforward. Your acceptance is based on wellness details you give or provide a life insurance policy business approval to get. Your price will certainly never ever raise and benefits will not lower as long as you pay your costs. 1 National Funeral Directors Organization, 2023 (funeral trust insurance companies). This short article is offered by New York Life Insurance Policy Firm for informational objectives only.

Life insurance is something most of us need, but don't all have. Possibly it's uneasy to think of, it's viewed to be as well expensive, or perhaps you're biding your time and waiting on a future day to get going. Honestly talking, if you're 55 years and older, that "future date" ought to be earlier instead of later.

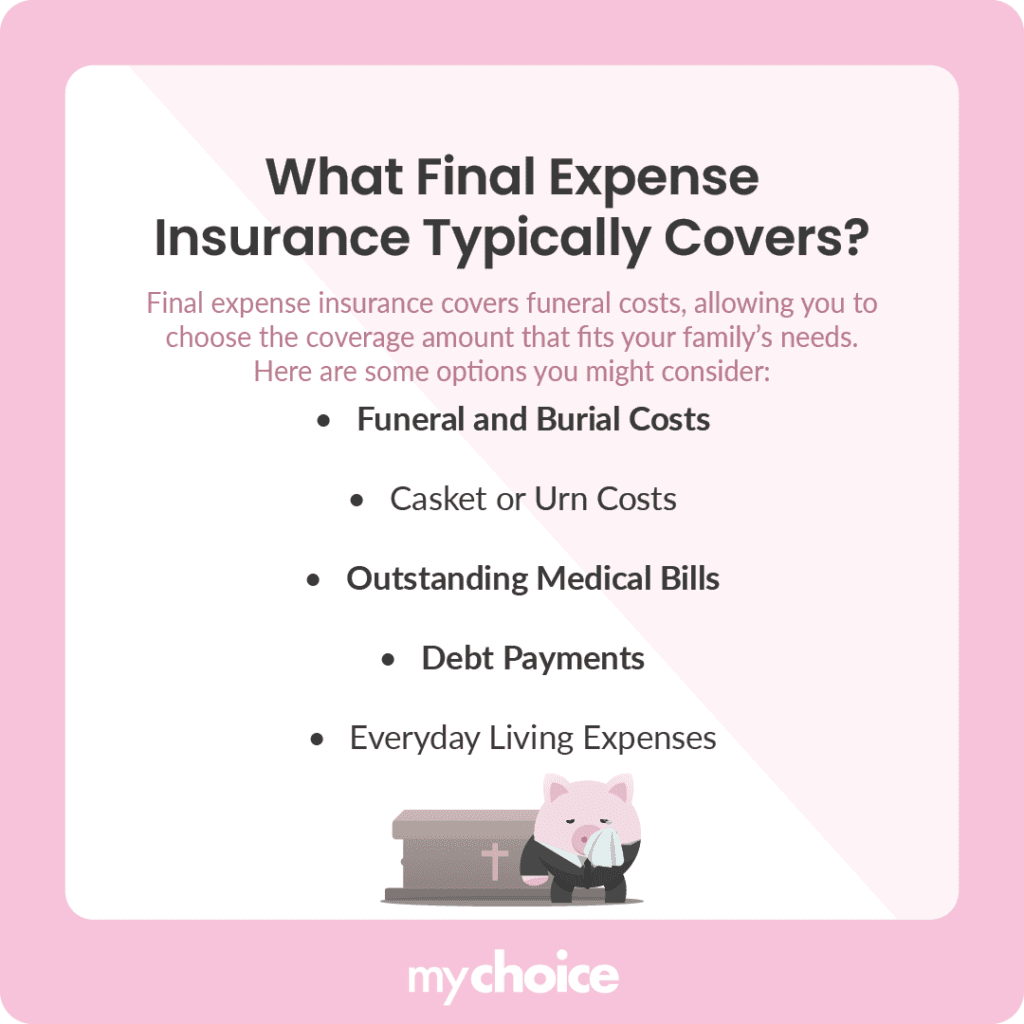

Assume: funeral and burial expenses, clinical expenses, mortgages, financing debt, and a lot more. That's where life insurance policy is available in (funeral plans compare the market). And it's even more affordable than you may think. Funerals Interments Debts Medical bills Home loans Immediate home expenditures Lends Tax obligations Probate costs Qualification is restricted to those 55 to 80 years of age.

Need even more protection? Speak with among our local, independent representatives about your insurance coverage needs, and they'll direct you to the security that's right for you.

This ABR pays earnings that are meant to receive beneficial tax obligation therapy under area 101(g) of the Internal Revenue Code. benefits of funeral insurance. The government, state, or neighborhood tax obligation effects arising from settlement of an ABR will certainly depend upon the particular facts and situations, and subsequently advice and guidance need to be gotten from a personal tax obligation consultant before the invoice of any type of settlements

Term Life Burial Insurance

Cyclist Figures: ICC21-21468, 21468, 21468-5, 21468-10, ICC21-21469, 21469, 21469-5, 21469-10, ICC21-21470, 21470, 21470-5, 21470-35, 21470-42, ICC15-15200, 15200, 15200-7, 15200-10, 15200-35, ICC15-15201, 15201, 15201-7, 15201-9, 15201-10, and 15201-35. This is not a preneed insurance policy contract or contract. Advantages are payable to the beneficiary or beneficiaries as routed by the proprietor of plan.

For an estimate of the year, the costs may go beyond the quantity of insurance coverage, divide the face quantity by the annual costs. THIS PLAN DOES NOT WARRANTY THAT ITS PROCEEDS WILL SUFFICE TO SPEND FOR ANY PARTICULAR SERVICES OR GOODS SOMETIMES OF NEED OR THAT SOLUTIONS OR GOODS SHALL BE GIVEN BY ANY SPECIFIC SUPPLIER.

Last expense insurance coverage has a survivor benefit created to cover expenses such as a funeral service or funeral, embalming and a coffin, or cremation. Recipients can utilize the fatality advantage for any purpose, from paying residential property tax obligations to taking a vacation (insurance funeral). "They market the last expenditure insurance policy to people that are older and starting to think regarding their funeral costs, and they make it appear like they need to do it in order to deal with their family members," states Sabo

Last expenditure insurance policy is a tiny entire life insurance policy policy that is very easy to receive. The recipients of a final expense life insurance policy plan can use the policy's payout to pay for a funeral service, casket or cremation, clinical costs, taking care of home bills, an obituary, blossoms, and a lot more. Nonetheless, the death benefit can be used for any purpose whatsoever.

Funeral Cost Insurance Uk

When you obtain final cost insurance policy, you will not have to take care of a medical examination or allow the insurer access your medical documents. burial insurance for elderly. Nevertheless, you will need to respond to some health concerns. As a result of the health and wellness concerns, not everybody will get approved for a policy with insurance coverage that starts on day one

The older and much less healthy and balanced you are, the higher your rates will be for an offered quantity of insurance policy. Male tend to pay greater prices than ladies as a result of their shorter typical life span. And, depending upon the insurer, you might get a lower rate if you do not utilize tobacco.

Depending on the policy and the insurance firm, there may be a minimum age (such as 45) and maximum age (such as 85) at which you can use. funeral cover with no waiting period. The largest fatality benefit you can select may be smaller sized the older you are. Plans might go up to $50,000 as long as you're more youthful than 55 however just go up to $25,000 once you transform 76

Let's state you're retired, no more have life insurance coverage through your employer, and do not have an individual life insurance policy policy. Neither do you have a savings huge sufficient to ease the financial worry on your spouse and/or youngsters when you die. You're taking into consideration a new life insurance coverage plan. You speak to a life insurance policy representative and begin the application procedure.

Best Final Expense Life Insurance

The fatality benefit is what you're trying to find, however the premiums are also costly as a result of your age and health and wellness. The insurance policy business does not issue plans with a fatality advantage that's tiny enough to make the insurance costs fit your budget. At this point you may quit, assuming that you can't pay for life insurance policy

Anytime you die, your heirs will certainly get the death benefit you desire them to have, as long as you paid the premiums. Final expenditure insurance policy may not suffice to cover every little thing yet it can help your loved ones pay a minimum of some costs directly. These may be expenses they 'd otherwise have a tough time dealing with.

Life Insurance And Funeral Policy

Final expenditure insurance policy can eliminate the fears of your member of the family since it supplies them with cash they may need to pay expenses connected to your death (whole life insurance final expense policy). It can be a welcome selection for individuals that can't obtain any kind of other insurance coverage because of their age or health but wish to ease some monetary worries for enjoyed ones

There's a third type of last cost insurance coverage. This kind of plan might pay 30% to 40% of the death benefit if the insured passes away throughout the initial year the plan is in force.

If the insured dies after those very first 2 years, then the policy would certainly pay 100% of the death benefit. burial insurance canada. If you have health conditions that are just semi-serious, you may receive a rated benefit plan as opposed to an assured problem policy. These health and wellness problems consist of getting in remission from cancer cells in the last 24 months, congestive heart failure, or treatment for alcohol or substance abuse in the last 24 months

Selling Funeral Policies

With that said plan, you'll have to wait at the very least 2 years for any kind of protection. No solitary insurance company provides the most effective final expense insurance policy remedy, says Martin. It's essential to get deals from multiple insurer to discover the ones that see your health and wellness most positively. Those firms will likely use you the best rates.

Also if you have a less-than-ideal solution to a health and wellness concern, it does not imply every company will certainly reject you - burial insurance quote. Some might supply you prompt protection with greater costs, a graded benefit policy, or an assured concern policy. Investopedia/ Lara Antal If you have substantial financial savings, financial investments, and routine life insurance, after that you probably don't require last expenditure insurance coverage

Easy to qualify. Calls for answers to clinical questions but no clinical test. Costs never ever enhance. Survivor benefit can not be reduced unless you borrow against cash money worth or request increased survivor benefit throughout your lifetime. Heirs can utilize survivor benefit for any function. Death benefit is ensured as long as costs are paid and you do not have a term policy.

If he buys one of the most expensive plan with the $345 month-to-month premium, after 2 years he will certainly have paid $8,280 in premiums. His recipients will come out in advance if he passes away between the first day of year 3 (when the waiting duration ends) and the end of year 6, when the premiums paid will have to do with equal to the fatality benefit.

Table of Contents

Latest Posts

Cremation Policy

Group Funeral Insurance

Mutual Of Omaha Burial Insurance

More

Latest Posts

Cremation Policy

Group Funeral Insurance

Mutual Of Omaha Burial Insurance